Bitcoin (BTC) has moved to reclaim the $86,000 price level following a 2.65% gain in the last 24 hours. Notably, the premier cryptocurrency has maintained a bullish form over the past few rising by over 15% since retesting the $74,000 rice zone. Amid a potential resumption of the broader bull rally, prominent crypto analyst Burak Kesmeci has highlighted notable developments in Bitcoin short-term holders MVRV (Market Value to Realized Value) ratio.

Bitcoin Market Recovery Awaits Final Signal: Analyst

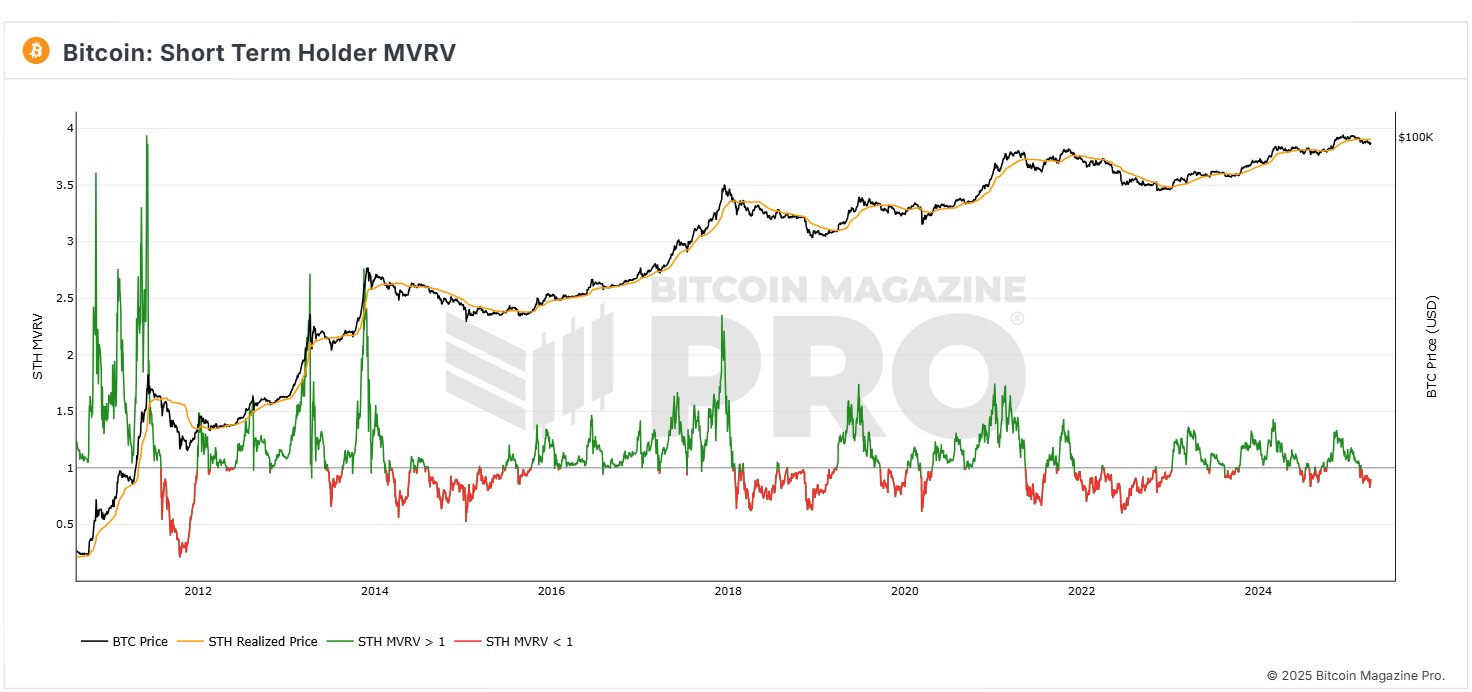

In a new post on X, Kesmeci explains that Bitcoin is showing early signs of a market recovery following recent developments in the Bitcoin MVRV for short-term investors. For context, the MVRV measures investors’ profitability by comparing the market value of an asset to the price at which it was acquired. An MVRV score below 1.00 indicates that the average holder is at a loss, while a score above 1.00 suggests profit.The MVRV for Bitcoin short-term holders i.e. addresses that have held Bitcoin for less than 155 days, is particularly important as this cohort of investors is usually the most reactive to price changes. Notably, the STH MVRV provides insight into market sentiment and potential price direction.

According to Kesmeci, the Bitcoin STH MVRV is now at 0.90, close to a profit level above 1.00. The STH MVRV had hit 0.82 amidst the recent “tax tariff poker” crisis, ignited by international tariff changes by the US government. Notably, this decline falls lower than levels seen during the Japan-based carry trade crisis on August 5, 2024, when STH MVRV dipped to 0.83. Over the last few days, the STH MVRV has climbed to 0.90 in line with the resurgence of BTC prices However, Kesmeci warns that Bitcoin must still cross 1.00 to confirm the potential for any significant price gains for short-term investors. Albeit, the rise from 0.82 to 0.90 remains a positive development that indicates an ongoing shift in market sentiment.

BTC Price Outlook

At press time, Bitcoin is trading at $85,390 following a slight price retracement in the past few hours. Amidst recent daily gains, the premier cryptocurrency is up by 2.11% on its weekly chart and 4.33% on the monthly chart as bullish momentum continues to build among investors. However, market bulls must offset the 38.98% decline in daily trading volume if the present uptrend must persist.Notably, BTC investors should expect to face ample resistance at the $88,000 price zone which has acted as a strong price barrier in previous times. Meanwhile, in the advent of any price fall, the immediate price support lies around $79,000.

Featured image from iStock, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Be the first to comment